I thought that this course was very beneficial, not only in its economic approach to internal business concepts, but also in its sociological and psychological approach as well. A lot of the time, I am frustrated that the models we use discount so much of the human element. While I understand that this is necessary for the purposes of simplification and education, it also leaves out a lot of the consequences of how the human element changes the models. This class struck a good balance between models, both graphical and mathematical, and the intuitive side of things.

I think that the pedagogic approach used in this class was well suited for the subject material that we were learning. Especially for the more intuitive concepts that revolved around the social sciences part of economics, I feel that our live class was very casual and conversational and that this contributed a lot to my understanding of the material. The excel homeworks were well made and did a good job of guiding me through the mathematical concepts underlying the models that we used. I didn't particularly like that the excel homeworks were all-or-nothing as far as getting credit, but I understand that this might be a result of how excel works. On a related not, there were times when I could do the math in my head but the homework wouldn't accept the answer unless it was a cell reference, forcing me to do the calculation in excel anyway. The blog posts didn't seem to help me understand the material any better since we would always discuss the prompt in class anyways, only in class it was more of a group discussion as well as being able to hear the professor's opinion on the matter.

As for my approach to doing the classwork, for the excel homeworks, I would give it an initial try and if there were no problems, I would take it as a sign that I am adequately familiar with the concepts. If not, I would stop trying to do it and would go back and build on my foundation of that knowledge. For the blog posts, I would type up my post in Microsoft Word while having the prompt open in another window, and then copy it over when I was satisfied with it. The excel homeworks would usually take me about an hour, sometimes more, and I would try to spend about an hour or more on the blog posts as well.

As for things that I would like to have seen, I think that having a few classes devoted to different managerial approaches and how these related to different styles of leadership might be beneficial. We touched on this a little bit, but there is much more out there and I feel like it is so closely related to the subject matter of this class that it should at least be addressed.

All in all, I thoroughly enjoyed taking this class and have had my perspectives broadened as a result.

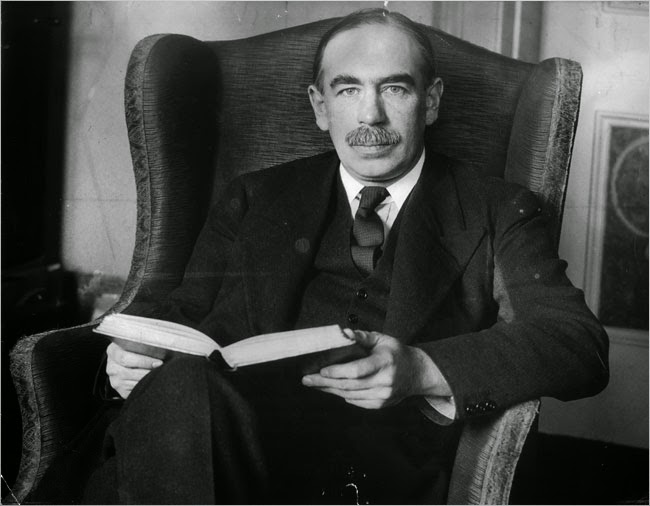

John Maynard Keynes Econ 490 Fall 2014 Blog

I am a student in Professor Arvan's Econ 490 class, writing under an alias to protect my privacy, using the name of a famous economist as part of the alias.

Friday, December 5, 2014

Friday, November 21, 2014

Implications of reputation

It is my view that reputation is the foundation upon which all economic activity is based. When two parties are in negotiations, they are taking into account each other's reputation and using it to their advantage. If their reputation is good, they are using it to bolster stability and confidence in completion of the deal. If their reputation is bad, it can justify a lower price or another mitigating factor.

I have personal experience in cultivating a reputation and then maintaining it. I am the sole proprietor of an eBay business, and when I first started my vendor account with them, I had no customer feedback whatsoever and people were hesitant to buy my items. This only reinforces my earlier point that people use reputation as the basis for their economic activity. When I didn't have a reputation on eBay yet (no customer feedback), my trading volume was very low, similar to those vendors that had bad customer feedback. After providing good service for a few months, I was able to accumulate enough good customer feedback so as to assure future buyers that I was a legitimate vendor and was not out to cheat anyone.

In a perfectly competitive market, both parties have complete information. However, in the real world, no one has complete information and a lot of the information is inferred from the reputations of their respective parties.

I have personal experience in cultivating a reputation and then maintaining it. I am the sole proprietor of an eBay business, and when I first started my vendor account with them, I had no customer feedback whatsoever and people were hesitant to buy my items. This only reinforces my earlier point that people use reputation as the basis for their economic activity. When I didn't have a reputation on eBay yet (no customer feedback), my trading volume was very low, similar to those vendors that had bad customer feedback. After providing good service for a few months, I was able to accumulate enough good customer feedback so as to assure future buyers that I was a legitimate vendor and was not out to cheat anyone.

In a perfectly competitive market, both parties have complete information. However, in the real world, no one has complete information and a lot of the information is inferred from the reputations of their respective parties.

Friday, October 31, 2014

Bargaining

Every day that I go into work, I participate as an agent in a triangle-like arrangement. I work for the iHotel and Conference Center, and so a lot of our events are weddings and banquets and the like. During the event, I must coordinate the guest's wants with our facilities capabilities. Things can get really complicated on weekend nights, which is usually when we'll host weddings. There is no fury like that wrought by the bride's mother. So as you can imagine, it is very important in these situations to not only make sure that the bridal party is happy with the arrangements but it is also necessary to make sure that the wedding isn't interfering with any other events that may be ongoing.

For example, there was a wedding one time where the DJ brought in some of the biggest speakers that have ever been inside the Conference Center. He said they were meant for outdoor concerts but they were all he had available that night. When he turned them up and started playing music, every light in the building was rattling, the glass on the doors was shimmering from the vibrations, and every other event in the Conference Center at the time came to the front desk to ask what the hell all the noise was from. In that case, we had to tell the DJ to keep it a little quieter until later in the night when the other events were done. For the most part though, I, acting as the agent, will usually satisfy the bridal party over the concerns of our other events because it is such a 'special' day for them.

However, things get really interesting when we have two weddings go on at the same time. Now, I have no options where I don't impinge on someone's special day. This is a worst case scenario because after I have gotten done arbitrating the two parties, neither one feels satisfied and both feel that I am to blame. This leads to me altering my behavior so that I can prevent bad things from happening before they happen, even if that prevention looks intrusive to someone that isn't aware of the future possibilities. For example, if one wedding has an open bar and one wedding has a cash bar, then there have been times where people will crash the other wedding, get free drinks, and then bring them back to the original wedding. In order to prevent this, I can stand in the hallway between the two weddings and not allow people to go on the other side. This can seem intrusive and arbitrary to those who I turn away, but it is necessary because I am prevents a much larger problem.

In this example, the way that people would choose the arbitrator would be to shop around at different conference centers or banquet halls, and the way that the arbitrator could choose their clients would be to accept or decline any events from those people. I feel that this situation is rather common and can be applied in many places, such as the labor market, internal organizational policies, and governmental initiatives.

For example, there was a wedding one time where the DJ brought in some of the biggest speakers that have ever been inside the Conference Center. He said they were meant for outdoor concerts but they were all he had available that night. When he turned them up and started playing music, every light in the building was rattling, the glass on the doors was shimmering from the vibrations, and every other event in the Conference Center at the time came to the front desk to ask what the hell all the noise was from. In that case, we had to tell the DJ to keep it a little quieter until later in the night when the other events were done. For the most part though, I, acting as the agent, will usually satisfy the bridal party over the concerns of our other events because it is such a 'special' day for them.

However, things get really interesting when we have two weddings go on at the same time. Now, I have no options where I don't impinge on someone's special day. This is a worst case scenario because after I have gotten done arbitrating the two parties, neither one feels satisfied and both feel that I am to blame. This leads to me altering my behavior so that I can prevent bad things from happening before they happen, even if that prevention looks intrusive to someone that isn't aware of the future possibilities. For example, if one wedding has an open bar and one wedding has a cash bar, then there have been times where people will crash the other wedding, get free drinks, and then bring them back to the original wedding. In order to prevent this, I can stand in the hallway between the two weddings and not allow people to go on the other side. This can seem intrusive and arbitrary to those who I turn away, but it is necessary because I am prevents a much larger problem.

In this example, the way that people would choose the arbitrator would be to shop around at different conference centers or banquet halls, and the way that the arbitrator could choose their clients would be to accept or decline any events from those people. I feel that this situation is rather common and can be applied in many places, such as the labor market, internal organizational policies, and governmental initiatives.

Friday, October 17, 2014

Thoughts on Future Income Risk

As I was progressing through high school, I was told repeatedly that the point of going to college was to prepare myself to join the workforce and to give myself a head start in life. It made perfect sense to me at the time, and I still think it is good advice. But I had missed the essence of the advice. It wasn't necessarily what courses I took or what grades I got that would give me that head start. Sure, these things are important and are going to be used as a metric for evaluation in the future. But preparing for the workforce? The head start in life? That was from living through the experience: having to learn things that were so new that every sentence seemed like gibberish, or learning that failure is part of the process of growing. However, this experience comes with a pretty high cost, and it is up to those who choose to go to college to make sure that we minimize our future income risk while we increase our human capital.

Coming into college, I did not have a lot of money to throw around. I had gotten enough money from the school to pay for the tuition and some of the housing costs of living at the dorms, which was mandatory for freshman. As a result, I had to take out loans to pay for the rest of the dorms as well as books and other incidentals, which totaled several thousand dollars in loans. The following year, my scholarships from the university were reduced, and so I had to take out even more loans as well as pick up a part-time job. This is when I started to really contemplate the long-term costs of going to college. At this rate, if I didn't start really excelling in my classes and networking like crazy, it might not have been worth coming here.

In order to try to minimize the debt that I was accumulating, I would work full time over the summer and save up money that I could use throughout the school year. I would then keep a part-time job during the semester to also lessen my loan burden. For every dollar that I could save up over the summer, I would save more than a dollar in interest by not taking it out in loans. In addition, I would get jobs at companies that would look good on my resume so that I could network as well as save up money for school. For example, I was an office assistant at a law firm for 3 summers. The pay was about average, but I was able to network with professionals in my field as well as having the benefit of having a law firm on my resume.

As far as older relatives go, I have a cousin that is 6 years older than me and took a similar path: graduated high school, then went to college for 4 years using loans and working part-time. She was okay with her debt upon graduation and for a few years afterwards. However, she ran into trouble about 5 years out of graduation when she bought a car, new furniture, and got a new apartment all within the same year. This put more strain on her than she thought it would and as a result, she had to work a second job, all but sacrificing the sacred "mid-twenties" social life. I will definitely keep this in mind post-graduation as complacency seems to blame here.

Coming into college, I did not have a lot of money to throw around. I had gotten enough money from the school to pay for the tuition and some of the housing costs of living at the dorms, which was mandatory for freshman. As a result, I had to take out loans to pay for the rest of the dorms as well as books and other incidentals, which totaled several thousand dollars in loans. The following year, my scholarships from the university were reduced, and so I had to take out even more loans as well as pick up a part-time job. This is when I started to really contemplate the long-term costs of going to college. At this rate, if I didn't start really excelling in my classes and networking like crazy, it might not have been worth coming here.

In order to try to minimize the debt that I was accumulating, I would work full time over the summer and save up money that I could use throughout the school year. I would then keep a part-time job during the semester to also lessen my loan burden. For every dollar that I could save up over the summer, I would save more than a dollar in interest by not taking it out in loans. In addition, I would get jobs at companies that would look good on my resume so that I could network as well as save up money for school. For example, I was an office assistant at a law firm for 3 summers. The pay was about average, but I was able to network with professionals in my field as well as having the benefit of having a law firm on my resume.

As far as older relatives go, I have a cousin that is 6 years older than me and took a similar path: graduated high school, then went to college for 4 years using loans and working part-time. She was okay with her debt upon graduation and for a few years afterwards. However, she ran into trouble about 5 years out of graduation when she bought a car, new furniture, and got a new apartment all within the same year. This put more strain on her than she thought it would and as a result, she had to work a second job, all but sacrificing the sacred "mid-twenties" social life. I will definitely keep this in mind post-graduation as complacency seems to blame here.

Friday, September 19, 2014

Thoughts on Opportunism

The more I think about opportunism, the more trouble I have defining exactly what it is. At the broadest level, everyone could be considered an opportunist because of the economic principle of assuming everyone acts in their own self-interest. What then is the difference between opportunism and self-interest? While I do see opportunism and idealism on opposite sides of the same spectrum, I don't believe that opportunism has to be inherently bad or unethical or unscrupulous or unidealistic.

Let us think for a second about acting out of self-interest. It can and will be different for everybody, because there are many facets of 'success'. We strive for many things: money, happiness, friends, respect, etc. We each have our own values assigned to each of those rewards, and based on those values, we make our decisions. This is where I believe opportunism comes into play. I define opportunism as a case of extreme self-interest: You pick one facet of success and maximize it, sometimes to the detriment of the other facets. For example, an opportunistic lawyer may have a lot of money, but may not be respected in his field due to his practices. Or lets take a look at the housing bubble that burst back in '08. The opportunistic mortgage brokers who were raking in piles of cash were maximizing their own financial gain at the expense of the economy in aggregate. While they probably knew at the time that they were plunging unassuming Americans into debt, they at least got their bonuses.

I would like to spend some time talking about the mindset of "good things come to those who wait" and how it relates to opportunism. At face value, it seems as if this quote is an example of how someone could pass up the chance to be opportunistic, but after some pondering, is this not also an example of someone with the patience and discipline to wait and observe the things around them before they act? How long is the 'wait' referenced in the quote? Are we waiting and doing nothing, or waiting and thinking, planning.

Overall, I think the entire concept of opportunism is very vague and does not have a solid enough foundation in order to be used in any kind of economic models.

Image credit: ska-studios.com

Let us think for a second about acting out of self-interest. It can and will be different for everybody, because there are many facets of 'success'. We strive for many things: money, happiness, friends, respect, etc. We each have our own values assigned to each of those rewards, and based on those values, we make our decisions. This is where I believe opportunism comes into play. I define opportunism as a case of extreme self-interest: You pick one facet of success and maximize it, sometimes to the detriment of the other facets. For example, an opportunistic lawyer may have a lot of money, but may not be respected in his field due to his practices. Or lets take a look at the housing bubble that burst back in '08. The opportunistic mortgage brokers who were raking in piles of cash were maximizing their own financial gain at the expense of the economy in aggregate. While they probably knew at the time that they were plunging unassuming Americans into debt, they at least got their bonuses.

I would like to spend some time talking about the mindset of "good things come to those who wait" and how it relates to opportunism. At face value, it seems as if this quote is an example of how someone could pass up the chance to be opportunistic, but after some pondering, is this not also an example of someone with the patience and discipline to wait and observe the things around them before they act? How long is the 'wait' referenced in the quote? Are we waiting and doing nothing, or waiting and thinking, planning.

Overall, I think the entire concept of opportunism is very vague and does not have a solid enough foundation in order to be used in any kind of economic models.

Image credit: ska-studios.com

Sunday, September 14, 2014

My Experience with Organizations

In the summer of 2012, I had a 3 month internship with Canadian National Railway, or CN for short. On paper, I was there as a signals and communications intern. However, it was clear from the start that they wanted us to have a 'unique' experience, and let us pick whether we wanted to travel or stay close, work in an office or in the field, and many other things of that nature. Because of this, I was able to get a real sense for the corporate culture there.

In the late 90's, CN merged with Illinois Central Railway. It made a lot of sense on paper, as CN's rails went mainly east-west while IC's went north-south along the Mississippi. And in the rail industry at the time, everyone was merging with everyone. However, over 10 years after the fact, when I showed up for my internship, I still experienced a distinct separateness.

The two cultures were never able to meld together, and so as a result, it often seemed like a competition or conflict when dealing with other divisions of the company, divisions that might have previously been from the other railway. One specific example that I can recall is the Locomotive Repair Shop that was located in Homewood, IL. Before the merger, it was one of the biggest, fastest, most impressive train shops in the country. However, after the merger, it wasn't as good as the one CN had somewhere else. And so it was ordered to be dismantled, to the theoretical benefit of the company, but a very hurtful move to those who were then being payed to dismantle their own job site.

On the topic of transaction costs, I feel that the relationship between company sprawl and transaction costs cannot be overstated. It is not necessarily the number of employees that increases the internal transaction costs, but their organization: how many departments with how many sub-departments. I think it is interesting as you can see this managerial approach in many new tech start-ups.

Sunday, September 7, 2014

A Bio Sketch of John Maynard Keynes

Keynes' work is relevant to the topics that will be covered in this course as he revolutionized the way that we think of business cycles in a free market. While looking at the economics of organizations and the reasoning behind their decisions, it will be useful to keep in mind where in the business cycle a business is or thinks it is.

Subscribe to:

Comments (Atom)