The more I think about opportunism, the more trouble I have defining exactly what it is. At the broadest level, everyone could be considered an opportunist because of the economic principle of assuming everyone acts in their own self-interest. What then is the difference between opportunism and self-interest? While I do see opportunism and idealism on opposite sides of the same spectrum, I don't believe that opportunism has to be inherently bad or unethical or unscrupulous or unidealistic.

Let us think for a second about acting out of self-interest. It can and will be different for everybody, because there are many facets of 'success'. We strive for many things: money, happiness, friends, respect, etc. We each have our own values assigned to each of those rewards, and based on those values, we make our decisions. This is where I believe opportunism comes into play. I define opportunism as a case of extreme self-interest: You pick one facet of success and maximize it, sometimes to the detriment of the other facets. For example, an opportunistic lawyer may have a lot of money, but may not be respected in his field due to his practices. Or lets take a look at the housing bubble that burst back in '08. The opportunistic mortgage brokers who were raking in piles of cash were maximizing their own financial gain at the expense of the economy in aggregate. While they probably knew at the time that they were plunging unassuming Americans into debt, they at least got their bonuses.

I would like to spend some time talking about the mindset of "good things come to those who wait" and how it relates to opportunism. At face value, it seems as if this quote is an example of how someone could pass up the chance to be opportunistic, but after some pondering, is this not also an example of someone with the patience and discipline to wait and observe the things around them before they act? How long is the 'wait' referenced in the quote? Are we waiting and doing nothing, or waiting and thinking, planning.

Overall, I think the entire concept of opportunism is very vague and does not have a solid enough foundation in order to be used in any kind of economic models.

Image credit: ska-studios.com

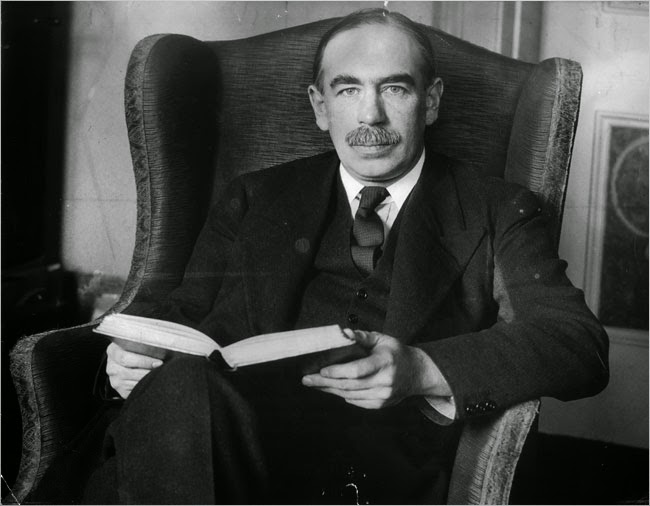

I am a student in Professor Arvan's Econ 490 class, writing under an alias to protect my privacy, using the name of a famous economist as part of the alias.

Friday, September 19, 2014

Sunday, September 14, 2014

My Experience with Organizations

In the summer of 2012, I had a 3 month internship with Canadian National Railway, or CN for short. On paper, I was there as a signals and communications intern. However, it was clear from the start that they wanted us to have a 'unique' experience, and let us pick whether we wanted to travel or stay close, work in an office or in the field, and many other things of that nature. Because of this, I was able to get a real sense for the corporate culture there.

In the late 90's, CN merged with Illinois Central Railway. It made a lot of sense on paper, as CN's rails went mainly east-west while IC's went north-south along the Mississippi. And in the rail industry at the time, everyone was merging with everyone. However, over 10 years after the fact, when I showed up for my internship, I still experienced a distinct separateness.

The two cultures were never able to meld together, and so as a result, it often seemed like a competition or conflict when dealing with other divisions of the company, divisions that might have previously been from the other railway. One specific example that I can recall is the Locomotive Repair Shop that was located in Homewood, IL. Before the merger, it was one of the biggest, fastest, most impressive train shops in the country. However, after the merger, it wasn't as good as the one CN had somewhere else. And so it was ordered to be dismantled, to the theoretical benefit of the company, but a very hurtful move to those who were then being payed to dismantle their own job site.

On the topic of transaction costs, I feel that the relationship between company sprawl and transaction costs cannot be overstated. It is not necessarily the number of employees that increases the internal transaction costs, but their organization: how many departments with how many sub-departments. I think it is interesting as you can see this managerial approach in many new tech start-ups.

Sunday, September 7, 2014

A Bio Sketch of John Maynard Keynes

Keynes' work is relevant to the topics that will be covered in this course as he revolutionized the way that we think of business cycles in a free market. While looking at the economics of organizations and the reasoning behind their decisions, it will be useful to keep in mind where in the business cycle a business is or thinks it is.

Subscribe to:

Posts (Atom)